[ad_1]

Coronavirus: US unemployment claims hit 26.4 million amid virus

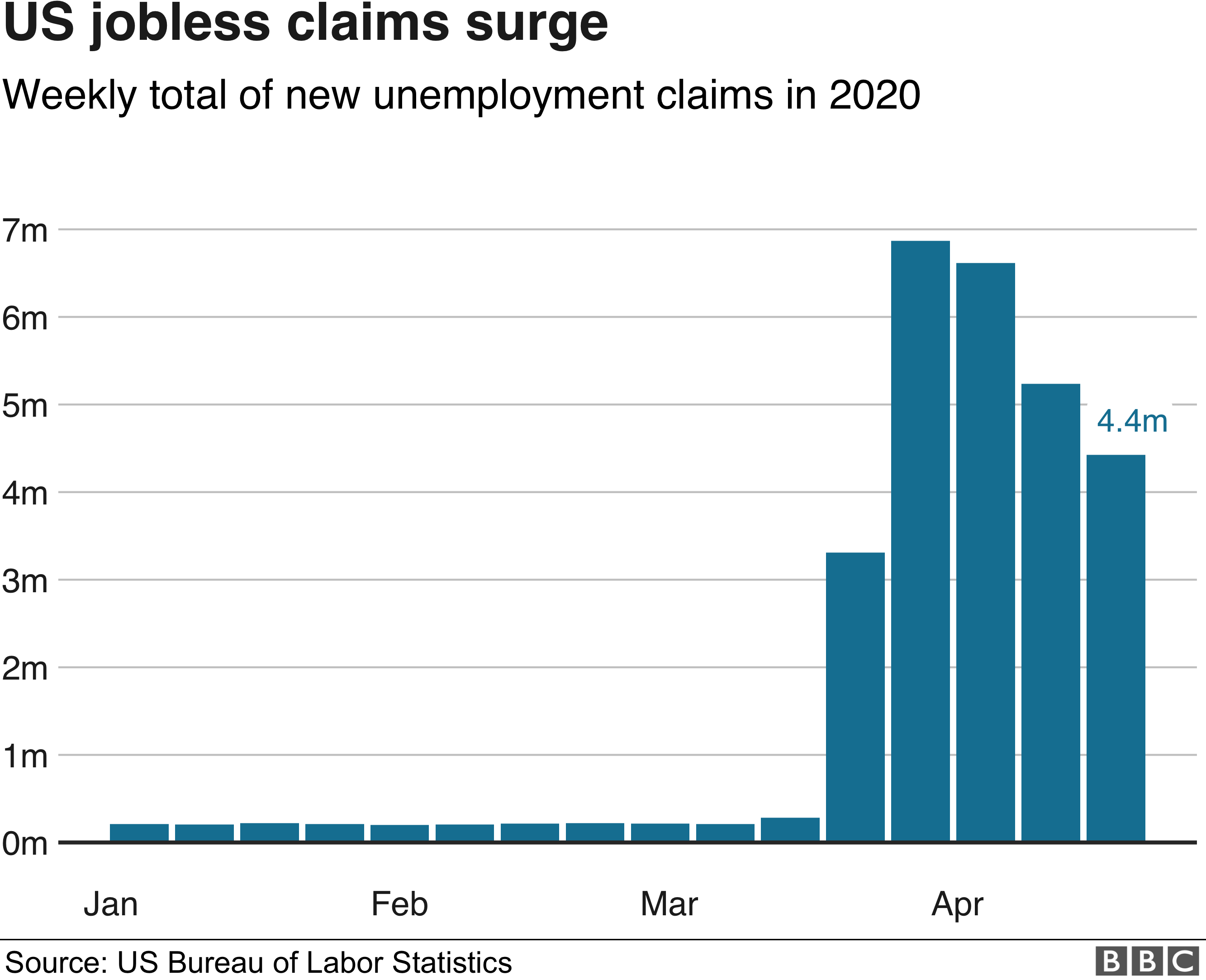

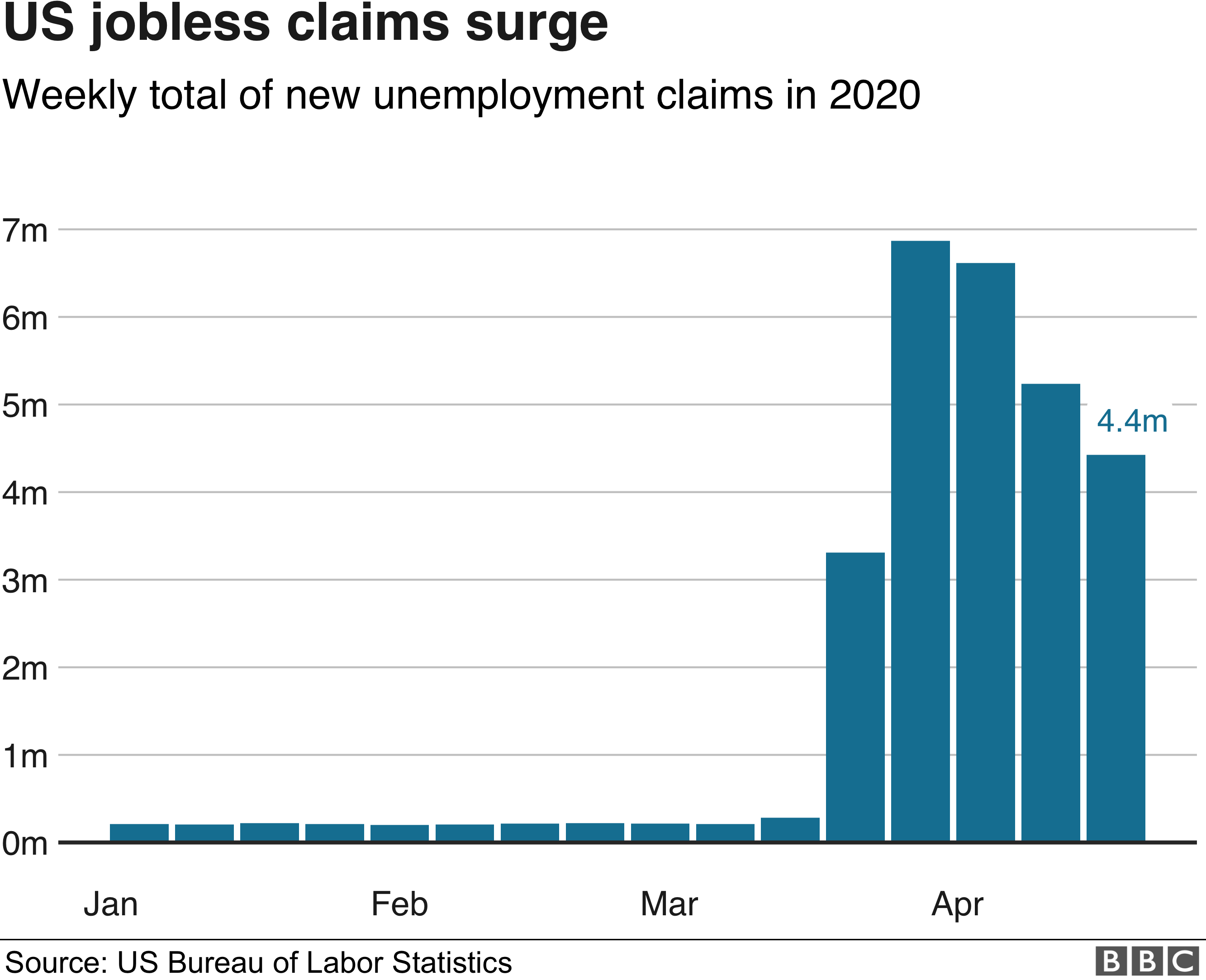

A further 4.4 million Americans sought unemployment benefits last week as the economic toll from the coronavirus pandemic continued to mount.

The new applications brought the total number of jobless claims since mid-March to 26.4 million.

That amounts to more than 15% of the US workforce.

However, the most recent data marked the third week that the number of new claims has declined, raising hopes that the worst of the shock may be over.

“While this week’s 4.4 million jobless claims are staggering, there are signs that the pace of layoffs has reached its peak,” said Richard Flynn, UK managing director at financial service firm Charles Schwab.

“The key questions at this point are when can the economy reopen and what happens when it does?”

Economists have warned that the world is facing the sharpest slowdown since the Great Depression in the 1930s.

In the US, the economy is expected to contract 5.9% this year, according to the International Monetary Fund. In just five weeks, the surge in unemployment claims has exceeded the number of jobs created in the near-decade of expansion that ended in February.

A Pew Research Center survey estimates that 43% of households have been hit by a coronavirus-related job loss or pay cut, a share that rises to more than half among adults with lower-incomes.

The US government has responded to the crisis with more than $2 trillion in relief, expanding eligibility for unemployment benefits and increased the payments, among other measures.

A record 16 million Americans received the benefits in the week ended 11 April, the Labor Department said. But many people have had trouble getting through to state offices processing the applications.

“The phones lines are often busy,” said John Dignan, a 52-year-old real estate agent in Nevada.

“It’s very frustrating because you have no control and no information. You already have so much anxiety about Covid-19, you know the economy’s falling apart and I don’t have much left in savings – maybe about a month left.”

A $349bn relief programme for small businesses, part of the $2tn rescue legislation, ran out of funds within two weeks.

While Congress is expected to approve an additional $310bn this week, the programme, which offers low-cost loans that do not need to be repaid if the recipient meets certain conditions, has been attacked for not reaching the smallest firms.

“We’re just waiting,” said New York restaurant-owner Larry Hyland, who applied the first day that banks started accepting applications on behalf of his Brooklyn-based beer garden, Greenwood Park.

Reviews have found that roughly two-thirds of the money so far has gone to large publicly listed companies rather than mom-and-pop shops. Firms with pre-existing relationships with banks – typically larger businesses – were at an advantage.

On Thursday, the administration responded to the criticism with new guidelines for the loan programme aimed at screening out big firms. But Mr Hyland said that even if he does get the money it may not help since it is supposed to be spent primarily on wages within eight weeks – and he remains closed.

“The timeline is the biggest issue,” he said. “Not knowing when you can actually reopen and to what capacity you can reopen, how can we take on the burden of that loan?”

US President Donald Trump, who is up for re-election in November, has pushed to loosen restrictions on activity, despite fears that testing and other safety measures remain insufficient.

Some states have already started to relax rules, while protests against lockdown orders have arisen elsewhere.

Even if jobless claims continue to subside as reopening gets underway, analysts say the scars on America’s consumer-driven economy will linger.

“The damage,” said Paul Ashworth, chief US economist at Capital Economics, “has already been done.”

The post Coronavirus: US unemployment claims hit 26.4 million amid virus appeared first on Citinewsroom – Comprehensive News in Ghana, Current Affairs, Business News , Headlines, Ghana Sports, Entertainment, Politics, Articles, Opinions, Viral Content.

Advertise Here contact ads[@]ghheadlines.com