[ad_1]

New market highs may only be a year away.

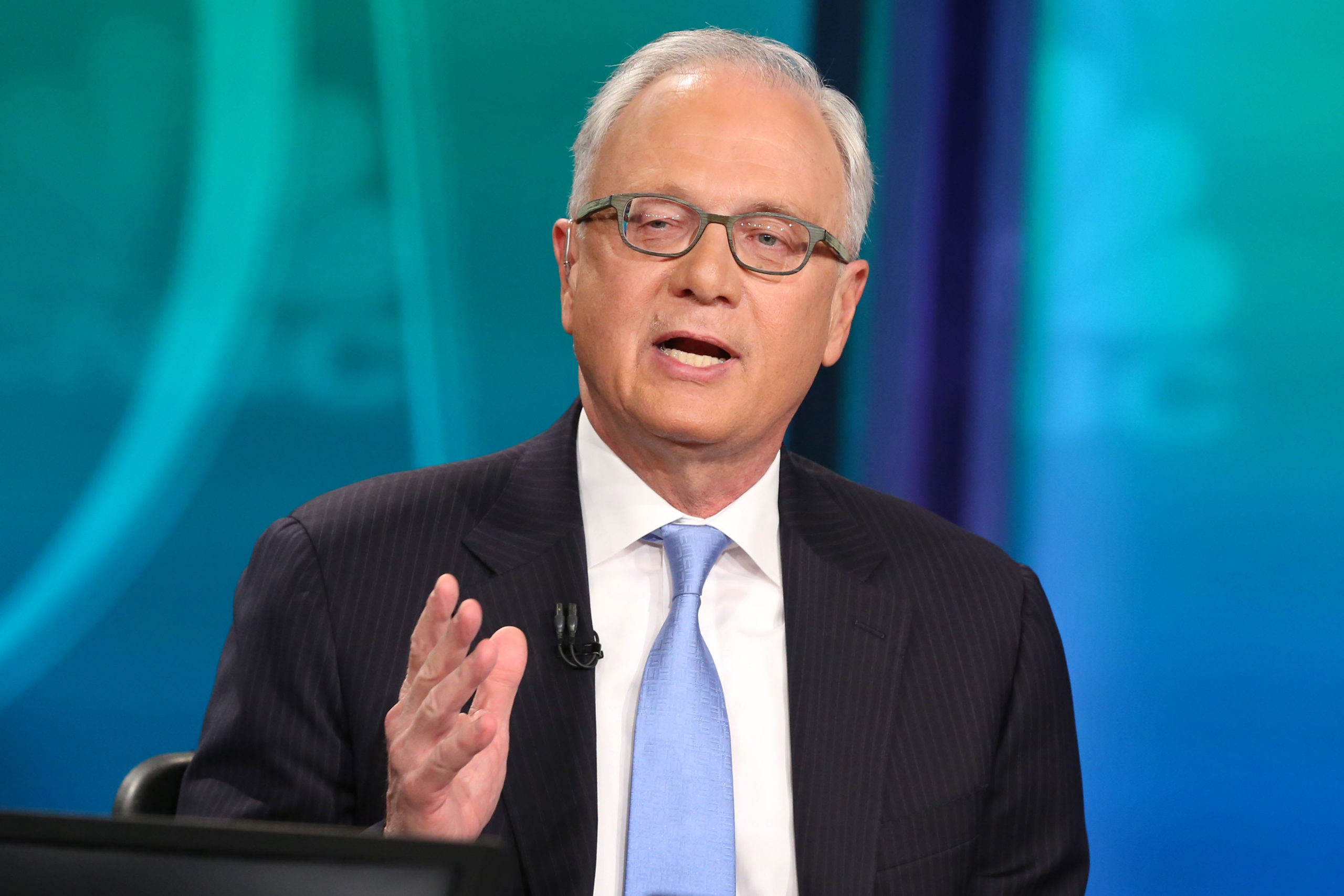

Long-time bull Edward Yardeni believes the Federal Reserve’s coronavirus policies are already providing a boost to stocks and putting them on track for a record 2021.

“On March 23, we made a low exactly on the same day that the Federal Reserve introduced what I call ‘QE4ever.’ The Fed announced that they were going to purchase bonds for the foreseeable future,” the Yardeni Research president told CNBC’s “Trading Nation” on Friday. “They didn’t put any end date on it. They didn’t put any limit on it.”

It’s a key move that suddenly gave investors the opportunity to get out of bonds and buy stocks cheaply, according to Yardeni.

“If we have another opportunity for any downside, I think you’ll see more re-balancing which very much reduces the likelihood that we’ll be able to get back to the March 23 lows,” he said.

Yardeni, who spent decades on Wall Street running investment strategy for firms including Prudential and Deutsche Bank, saw trouble brewing in the market before much of Wall Street.

On the show in early February, he warned the coronavirus was the biggest threat to the record market rally, and he advised investors to put some cash on the sidelines. Yet, stocks continued hitting new milestones up to about two weeks later.

Early last month, Yardeni lowered his year-end S&P 500 price target from 3,500 to 2,900.

“We’re basically almost there already,” he noted. “I’m not going to get too cute about it. I think we’re still going to be around this level by year-end.”

But now with the notion coronavirus cases are peaking and the U.S. economy is closer to re-opening, Yardeni’s optimism is growing.

“It seems a little out of place to talk about a new high when obviously the economic indicators are horrible. But the market does look forward,” he said. “Sometime next year, maybe by the end of next year, we’ll be moving toward 3,500. We got as high as 3,300 back in February.”

However, his forecast comes with a caveat: The U.S. economy must open before summer due to the severe damage caused by the shutdowns.

“I would get very concerned if we keep this thing locked down past May,” Yardeni said. “In that scenario, we’re not talking about a ‘V’-[shaped economic] recovery. I mean we wouldn’t even be talking about a ‘U’-recovery. Something more like an ‘L’, and I certainly wouldn’t want to see that.”