One of the most impactful economic decisions by the NDC government was the strategic formalization and promotion of gold exports, culminating in the establishment of the Ghana Gold Board (GOLDBOD). This initiative has been a cornerstone in the nation’s recent economic stabilization efforts.

The Undeniable Benefits of the Gold Board Initiative.

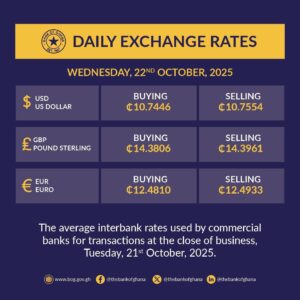

1. Taming the Cedi’s Depreciation: By leveraging gold, the NDC government has created a powerful, tangible asset to defend the cedi, moving beyond the traditional cycle of depreciation that often plagued the economy as we witnessed under the NPP.

Let’s not forget how 1 dollar at a point on November 2024 was going for 17.20 cedis.

Today, the cedi remains Africa’s best currency

2. Boosting Domestic Value Addition: The initiative is strategically designed to ensure more of the final value of Ghana’s gold benefits the local economy, rather than being entirely captured abroad.

It’s a fact that Ghana was losing nearly 11 billion dollars through Gold Smuggling and the establishment of Gold Board has raked in more than half of what Ghana used to lose before the establishment of Gold Board.

3. Fortifying International Reserves: The most significant outcome has been the rapid accumulation of gold by the Bank of Ghana (BoG) in its reserve.

As of October 2025, gold constitutes a substantial 45% of Ghana’s Gross International Reserves (GIR).

This asset provides a crucial buffer, bolstering investor confidence and the central bank’s ability to manage economic shocks when they arise.

However, this success story is built on a foundation with a known and significant risk that needs to be managed properly.

Gold’s price volatility, as the world’s leading gold producer in Africa, Ghana is uniquely exposed to these global price swings of Gold because Gold is a Historically Unpredictable Commodity.

Today the price can be at a record high, and the next day it can drop to a record low.

Notwithstanding, Gold remains a classic “safe-haven” asset.

But then, its price typically peaks during periods of global uncertainty or when the US dollar struggles, and falls when the dollar strengthens and global markets are stable.

This inverse relationship is a fundamental characteristic of the global market.

This volatility is not theoretical, it is something that is known with a basic understanding of economics.

As it stands now, Gold has experienced monthly and quarterly price volatilities of approximately 13% and 14.5%, respectively.

These are substantial swings that can occur rapidly based on global economic data, central bank policies in major economies, and shifts in investor sentiment.

The current situation, where nearly half of the nation’s international reserves are tied to a single, volatile commodity, represents a severe concentration risk that needs to be looked at.

While a 45% allocation has been beneficial during a price upswing, it leaves the entire reserve portfolio and by extension, the Ghanaian economy highly vulnerable to a downturn or external shocks.

Failure to proactively manage this risk could unravel the very gains the NDC has achieved in its 10th months in Government heading towards its 1st year in Government.

How Gold Board Is structured To Work With Bank Of Ghana

Below is what could happen if the issue of over concentration of Ghana’s reserve on Gold is not looked at impartially.

1. The BoG provides capital to the Gold Board.

2. The Board buys gold from small and medium-scale miners at prevailing high prices.

3. A significant, inevitable correction in the global gold price occurs.

4. The BoG is left holding a large reserve of gold that has suddenly depreciated in value, crystallizing a massive loss on its balance sheet.

This would not be a paper loss; it would directly erode the value of our international reserves, weaken the cedi, and potentially trigger a crisis of confidence that could wipe out the economic progress made in recent years.

To secure the gains and shield the economy from this foreseeable danger, we as a media platform propose an immediate and strategic policy shift: the implementation of a cap on the gold holdings within the BoG’s reserves.

Under this proposal:

i. The BoG would maintain its current gold reserves at a predetermined, optimal percentage (e.g., the current 45% or a slightly lower, more conservative figure).

ii. Any gold production acquired beyond this cap would be systematically sold on the international market for US dollars and other stable foreign currencies to be kept by the Bank of Ghana

The Dual Advantage of this Strategy

1. Risk Mitigation: It diversifies the nation’s reserve portfolio, reducing over-reliance on a single asset and protecting it from gold’s inherent price volatility.

2. Enhanced Liquidity and Stability: The conversion of excess gold into dollars would inject much-needed foreign exchange into the economy.

This would directly benefit traders and businesses struggling to access dollars for essential imports, further stabilizing the local currency and supporting economic growth.

The time for action is now, while gold prices are at a record high.

This is not a critique of a successful policy, but a necessary evolution of it.

We want the Government to succeed and we remain committed to expressing our opinions in the best way for the country’s good.

Prudent risk management is the hallmark of a mature and resilient economy. We must act decisively to cap our gold reserves and convert our current prosperity into lasting, stable economic security.

The future of the Ghanaian economy depends on it.