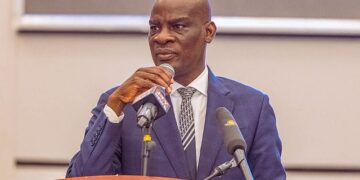

The Minister of Food and Agriculture, Dr Owusu Afriyie Akoto has revealed that the government will soon introduce a bill to be presented to Parliament for approval that will compel commercial banks in Ghana to give loan to farmers.

He explained that the government has done its part in supporting the farmers by subsiding inputs therefore, the banks will have also play their role in ensuring sustainable food production in the country by giving out loans to the farmers and other players in the sector.

Dr Afriyie Akoto said Ghana would not be the first country to introduce such a law, citing India as an example which he said has done it for over 30 years.

He said these when he toured some selected commercial farms in the Eastern Region over the weekend monitored by TV3’s Eastern Regional Correspondent Yvonne Neequaye.

He further explained that the cost of farming has hot up due to factors beyond the control of government.

“When we met the poultry farmers, it is very obvious that prices of poultry feeds which make up 70 per cent of cost of production has gone up. If you compare prices this year in January, February, March, April and May, and compare to the same period in 2021, 2020, 2019, the prices have shot up. They have shot up for very simple reason that the chemicals have gone up two or three times and that means the cost of production has gone up on the farm.

“At the same time, fuel prices have trebled and it means that haulage from the farm gate to the centres of consumption have also gone up. So, these we don’t have control over, these are external factors that are impacting seriously on the price formation.

“The thing is that because of that the cost of doing business in Agriculture has gone up and that is why poultry farmers for instance, those who were doing 150,000 birds, have now reduced to 50,000 because their working capital cannot support the new higher prices. That is where the banks have failed us in agriculture, because the banks which are doing business with these poultry farmers should be able to give them credit to sustain their production at those levels or even increase it.

“Unfortunately, the banks have stayed away and therefore they are having to reduce the level of level of production. Their interpretation had been that government, in spite of all that is happening we had done anything. [But] we took the trouble, more than one and half hours, to explain to them what the government is doing in trying to rectify the situation. After the explanation it was obvious that they were very satisfied with the efforts we have made.

“We are making a whole lot of efforts to ensure that we bring in the commercial banks including possibility of introducing legislations so that commercial banks would have to lend a portion of there portfolio to farmers and those in the value chain, the processers and others. We wouldn’t be the first country in the world to do that, India has been practicing that for 30 years.

“So definitely you are going to hear something in Parliament about this issue, as a way of making sure the commercial banks plays their role because government is playing its role by subsiding inputs and fertilizer, the banks should be able to lend to agriculture.”

Source:3News