[ad_1]

This chart from Social Security Works shows where the benefit would go: Trump, members of Congress, and CEOs of Wall Street banks and Fortune 500 companies would get an annual tax cut of $2,754. Unemployed workers and the millions of state and local workers who contribute to state pension programs rather than Social Security would get $0 in tax cuts. Zero. Dollars.

Of course, employers already got their deal, albeit temporarily. The CARES Act gave them a reprieve from their portion of payroll taxes until the end of the year in order to try to encourage them to keep people on payroll. Trump argues that he wants to give workers the same benefit, but for millions of them, it’s bullshit. And it won’t help those in the most dire straits at all—they don’t have a paycheck in the first place. Nothing is being withheld from them. As Len Burman, a fellow at the Urban Institute says, it’s a “terrible idea.”

“The main problem with the proposal is that it would go to the people who least need help,” Burman told CNBC. “It seems like you’re deliberately targeting it to people who are in the best situation […] the ones who are still working.” Ding, ding, ding. Beyond that, it threatens the most vulnerable among us now; the payroll taxes being paid into Social Security are helping to keep seniors afloat.

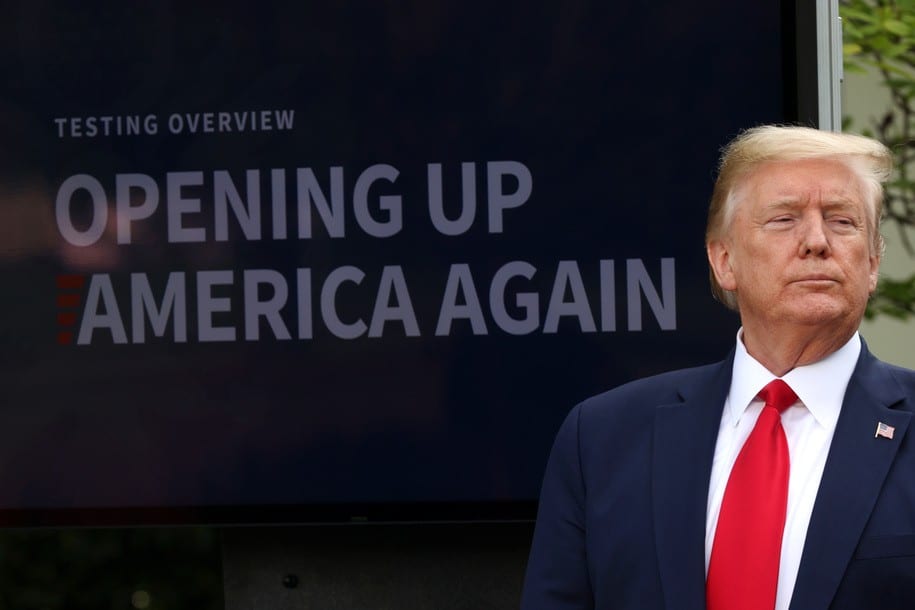

“Trump’s actions are a war on seniors,” Nancy Altman, president of advocacy organization Social Security Works, said in an emailed statement. “He wants to open up the economy, even though COVID-19 is disproportionately costing seniors their lives. Now he is insisting on threatening Social Security on which most seniors rely for their food, medicine and other basic necessities.”

This is a demand that Democrats should have no problem whatsoever refusing. It does absolutely nothing for the people who need assistance the most and will harm them in the long run.